Unit 4 Money talks

知识点一:Text Analysis: The credit card trap

知识点一:Text Analysis: The credit card trap

I. Warming up

1. Do you know how banks make money?

First have a discussion with your partners and describe briefly about the way banks make money. The following are some possibly involved words.

(1) deposit 存款 (2) savings account储蓄帐户

(3) interest rate 利息率 (4) loan贷款 (5) margin / difference 差额

2. Watch a video clip and discuss the questions in groups.

1. What are the advantages of having a credit card?

You can pay for goods and services without using cash or a cheque which means that you only need to carry one card around with you.

You can spend more than you have.

2. Which sort of customers do the credit card companies hate?

people who pay off their bills on time

3. What are good customers for credit card companies?

people who don’t pay off their credit card debts

4. How do credit card companies make profits?

charging interest rates

5. What are the dangers of having a credit card?

Improper use can damage credit rating

Higher risk for impulsive buying and overspending

Debt trap when used unwisely

Expensive way to borrow due to high interest rates

Less to spend in the future due to paying off purchases from past

Possible hidden fees & surcharges

Privacy is an increasing concern

Identity theft easier

II. Background

Russell Baker (1925– )

He is a well-known American journalist and writer. This passage was collected by Sandra Fehl Tropp and Ann Pierson D’ Angelo in their edited book Essays in Context (2000), published by Oxford University Press. The essay leads readers to think from a child’s perspective and to evaluate how a job is seen and understood in corporate America. It uses satire and humour to illustrate the writer’s critical views on corporate America.

III. Text analysis

Text Organization:

Discussion:

Look at the sentences from the passage and answer the questions.

1. I have a confession.

Has the writer done something seriously wrong?

No, but it makes an interesting and ironic beginning. It is interesting because the writer is about to reveal a personal statement, which draws the reader into the passage. It is ironic because the confession is actually about something small and quite trivial. Nevertheless, the writer uses the story to raise serious issues about credit cards and banks – since the 2009 world crisis in banking we know that this really is serious.

2. She hugged me (never usually does that) and then said, “Mum, I need to talk to you.”

Why does the writer add the detail in brackets?

It tells us – as an aside – that the hug is unusual. This draws attention to how the daughter is being unusually nice to her mother because she wants to make a special request. From the mother’s point of view, such a hug is a warning that the daughter is going to raise a serious matter.

3. How did she do this? How could this be? I knew I earned more than her, my car was newer, and my house was smarter. How did she get to appear more flash than me?

What effect does the series of questions have?

These are rhetorical questions. They share the writer’s feelings with us and have the effect of emphasizing how the writer was puzzled and annoyed by the high-status gold card of her friend.

4. She has a student loan of £3,000, like most of her friends, and a small allowance from her poor mother (ha!) for transport, books, living expenses.

Ha! is an aside which indicates a laugh. What is the laugh for?

This seems to be a mocking or ironic laugh. Her mother is poor, but still has money to give her daughter an allowance. Of course, this is the writer speaking about herself as a mother.

Paraphrase:

1. My credit card was a fairly pathetic, status-free dark blue, whereas hers was a very exclusive gold one.

My credit card was quite useless in an annoying way. It was dark blue and ordinary, and it did not have any particular status. Hers was gold and was limited to a particular group. So the writer felt inferior and wanted a gold credit card too.

2. Now, I had a job which was as steady as any job was in those days – that’s to say, not very, but you know, no complaints.

In those days a steady job often became not so steady because in the bad economic situation many people would lose their jobs – no job was steady, including the writer’s – but at least she had a job. So she did not really have any complaints.

3. They target people who are prone to impulse-buying, and potentially bad credit risks, tempted to spend more than they have, and liable to fall behind with repayments.

The credit card companies or banks direct their advertising and sales promotions at people who are very likely to buy things on impulse (without planning), who may not be able to pay their debts, who spend more money than they have, and who will not make repayments on time.

4. Her bank! I trusted them! They know even better than I do how broke she is.

The writer was very surprised that her daughter’s bank was offering her daughter a credit card because she knew that her daughter had no money at all, and the bank knew this even better than she did.

The exclamation marks emphasize the feelings of the writer: The bank seems to exploit the daughter’s financial situation.

5. … and it’s probable that she’ll have another go at university when she has paid off her debts.

Because of her debts, Kelly couldn’t get a student loan, so for financial reasons she dropped out of university and got a job in a supermarket. When she has paid off her debts, she may well go back to university and try again to finish her degree.

6. You’ve got the whole world into this ridiculous credit card trap …

This is part of the writer’s humorous advice about what we should say to the banks: You have got everyone into this silly and unreasonable credit card trap – you have caught us in this bad situation that is difficult to escape from.

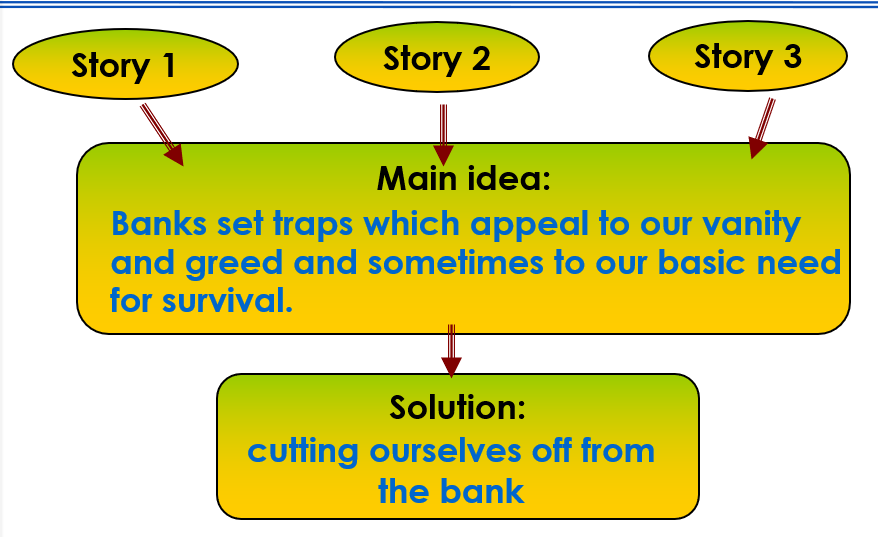

Summary:

Today, we are caught in the credit crunch because banks set traps which appeal to 1)___________________________________________________________. The banks give a false sense of superiority to people with 2)_______________________ in hard. They target people who are prone to 3) ________________, and 4) potentially ________________, tempted to 5) ____________ ______________, and liable to 6) ________________________. They lure impoverished students with 7) ______________________. They charge people who go over the limit the exorbitant interest but omit to tell them the interest paid is not for the debt, but for 8) _________________________. By attracting us with their 9)_________________ for loans of money, the banks earn money. So how to get ourselves out of the traps? Lay out all of your credit cards in a line, take a large pair of scissors and cut them into small pieces. Then the banks have no 10) ____________________________________.

Keys: 1. our vanity and greed and sometimes to our basic need for survival; 2. exclusive gold credit cards; 3. impulse-buying; 4. bad credit risks; 5. spend more than they have; 6. fall behind with repayments; 7. unrealistic interest rates; 8. the overspend of the overdraft; 9. endless publicity; 10. potential to tempt money away from you.

IV. Reinforcement:

Discussion

1. How have credit cards changed people’s attitude to money?

Credit cards make it seem easy to buy things or pay for services without handling money. If you don’t keep a careful personal record, it is easy to lose track of what you are spending (even though the bank will send you a monthly statement). This means that people may be encouraged to adopt a more casual and carefree attitude to money, so they will spend more. Since most credit cards have a credit limit which allows an overdraft, it also means that the cards can encourage people to get into debt when they cannot afford to do so.

2. Should schools teach children about money management?

You could say that schools already have a curriculum that is crowded: There are so many subjects to teach children about, many of which were not taught 20 or 30 years ago. So adding any new topic creates pressure on teachers and students. However, these days, money management seems an essential topic, so it should be taught in schools. Actually, the topic of money management is not new. What might be new is to bring together different aspects of money management to create a focus for children in both primary and secondary schools. These aspects would include financial calculations, setting goals, planning in steps and making decisions, ethics and morality in money management, relating money management to family life, and household budgets.

3. Would the world be able to function without banks? If so, would it be a better place to live in?

The roles of banks have become increasingly important. By the 19th century banks were indispensable for deposits, loans, credit transfer etc. Since the 20th century banks have become crucial to state functions, national and international commerce, business, and personal and family money management. Modern societies can hardly go back to pre-medieval times of trading sheep, cattle or wool, or land, or exchanging silver or gold, and even paper money seems largely redundant. It is difficult to think of any real alternative to banks. So, for now, we probably do need to keep banks. The present world can’t really function without them, but it would be a happier place if banks gave priority to trust, security and public benefits.