本章练习一答案

一、单选

1.A【解析】2016年的营业利润=1 000-600-(20+50+10+70-80-40)+25-15=380(万元)

2.C

3.A 4.C 5.C

6.D【解析】如果企业处于非持续经营状态下,财务报表的列报基础不是以持续经营为列报基础。

7.D 8.B

二、多选

1.AB 2.ABC 3.ABCDE 4.CD 5.BCDE 6.AC 7.ABCDE 8.AB 9.ABCDE

三、判断题

1.× 2.× 3.√ 4.√ 5.√ 6.× 7.× 8.√ 9.× 10.√ 11.× 12.× 13.√ 14.√

四、计算及账务处理题

1.营业利润=1 000-680-30-50-19+40-70-80=111(万元)

2.(1)编制甲企业经济业务的有关会计分录。

①借:原材料 308

应交税费——应交增值税(进项税额) 51

管理费用 0.2

贷:应付票据 351

银行存款 8.2

② 借:长期股权投资 720

贷:主营业务收入 600

应交税费——应交增值税(销项税额) 102

营业外收入 18

借:主营业务成本 470

存货跌价准备 30

贷:库存商品 500

借:长期股权投资 40

贷:投资收益 40

③ 借:应收账款 234

贷:主营业务收入 200

应交税费——应交增值税(销项税额) 34

借:主营业务成本 150

贷:库存商品 150

借:销售费用 2

贷:预计负债 2

④借:固定资产清理 126

累计折旧 74

贷:固定资产 200

借:银行存款 180

贷:固定资产清理 180

借:固定资产清理 54

贷:营业外收入 54

⑤借:银行存款 80

持有至到期投资减值准备 44

贷:持有至到期投资 109

投资收益 15

⑥ 借:固定资产 660

无形资产 420

银行存款 70

贷:其他业务收入 1 150

借:其他业务成本 1 230

贷:投资性房地产——成本 1 000

——公允价值变动 230

借:公允价值变动损益 230

贷:其他业务收入 230

借:管理费用(420÷5×1÷12) 7

贷:累计摊销 7

⑦借:应付票据 20

贷:银行存款 20

⑧借:管理费用 98

贷:累计折旧 98

(2)计算甲企业12月份的应交所得税及相关的递延所得税。

应确认的递延所得税资产=-30×25%(事项②)+2×25%(事项③)-44×25%(事项⑤)

= -18(万元)(转回)

应确认的递延所得税负债=-430(事项⑥)×25%= -107.5(万元)(转回)

【注】甲公司2015年12月业务⑥中要注意投资性房地产税法上折旧问题,此题中投资性房地产账面价值为1 230万元,计税基础为800万元,处置时转回的应纳税暂时性差异为430万元。

应交所得税=[119.8–30(事项②)+2(事项③)-44(事项⑤)+430(事项⑥)] ×25%

=119.45(万元)

借:所得税费用 29.95

递延所得税负债 107.5

贷:应交税费——应交所得税 119.45

递延所得税资产 18

借:利润分配—提取法定盈余公积 8.99

贷:盈余公积 8.99

(注:分录中单位为万元)

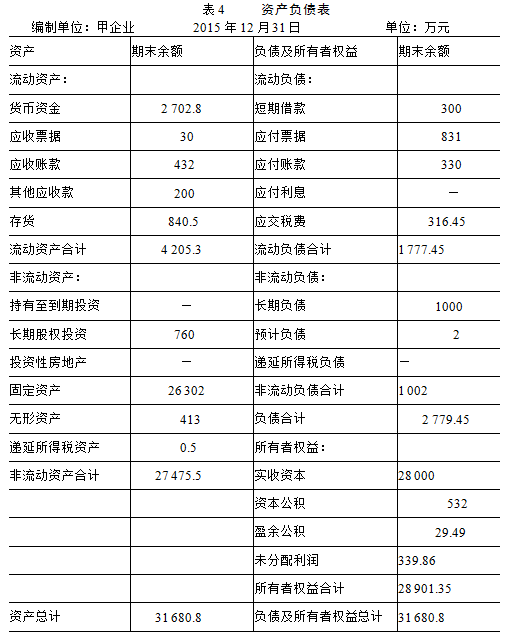

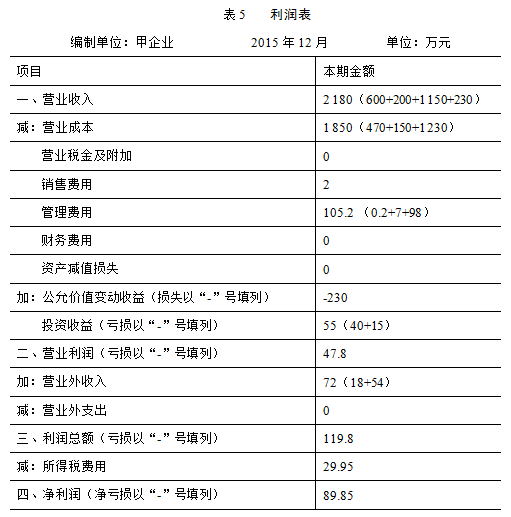

(3)编制资产负债表和利润表(见表4、表5)。